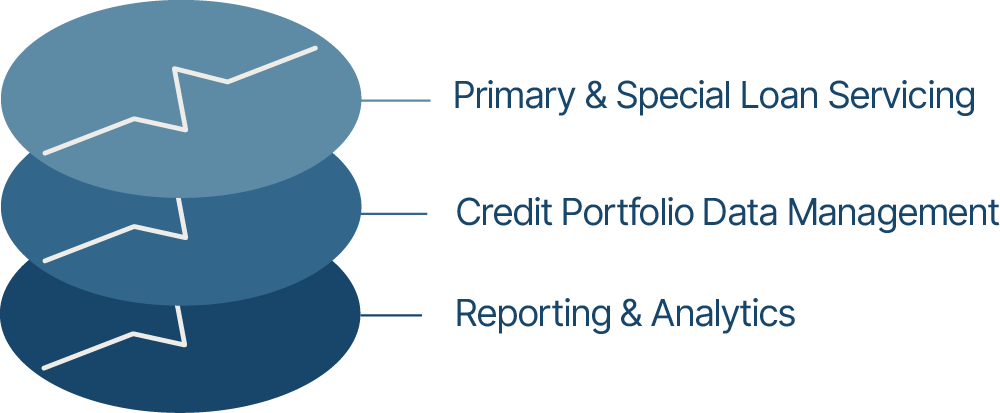

Our services

We move your technological hurdles so you can focus on your investments & growth.

Our extensive experience in resolving complex non-performing corporate loans is instrumental in how we approach our servicing of all credit asset

We provide end-to-end servicing for both performing and distressed credit portfolios—supporting asset managers, investors, and institutions across the full credit lifecycle.

Our integrated platform and expert team deliver:

- Seamless onboarding and administration

- Proactive borrower and lender engagement

- Rigorous financial and regulatory reporting

- Specialized workout strategies for distressed loans

Whether for day-to-day servicing or complex recoveries, we bring clarity, consistency, and control to your portfolio operations.

Operations

Credit administration, cash management, documentation

Transactional Support

Due diligence, transaction modeling, new lending, portofio onboarding

Accounting

Full financial accounting and reporting

Borrower Relations

Invoice and statement generation, borrower relations management

Recovery

Workout & recovery strategies for distressed assets

Third- Party Financing

Lender relations, reporting & covenant monitoring

Credit Servicing

All Credit types, one servicer

Reporting & Analytics

Our centralized data warehouse powers a complete reporting and analytics ecosystem. From investor updates and regulatory packages to real-time dashboards and custom exports, every output is driven by validated, structured data — delivered automatically, in the format each stakeholder needs.

Insightful portfolio views for daily monitoring

Performance Dashboards

Regulatory Packages

Audit-ready, standardized, and compliant

Advanced Analytics

Trends, triggers, and strategic insights

Multi-format Delivery

Excel, CSV, API, or platform-based

Investor & Stakeholder Reports

Structured, recurring, fully customizable

Automated Distribution

Right format, right time, right audience

Reporting & Analytics

Our centralized data warehouse powers a complete reporting and analytics ecosystem. From investor updates and regulatory packages to real-time dashboards and custom exports, every output is driven by validated, structured data — delivered automatically, in the format each stakeholder needs.

Insightful portfolio views for daily monitoring

Performance Dashboards

Regulatory Packages

Audit-ready, standardized, and compliant

Advanced Analytics

Trends, triggers, and strategic insights

Multi-format Delivery

Excel, CSV, API, or platform-based

Investor & Stakeholder Reports

Structured, recurring, fully customizable

Automated Distribution

Right format, right time, right audience

Our centralized data warehouse powers a complete reporting and analytics ecosystem. From investor updates and regulatory packages to real-time dashboards and custom exports, every output is driven by validated, structured data — delivered automatically, in the format each stakeholder needs.

We collect and ingest credit data from a wide range of sources — structured or unstructured, internal or third-party — including Excel files, client systems, flat files, and more.

After ingestion, raw data is mapped to our internal credit data model. Field names, structures, and formats are aligned into a unified schema, enabling consistent processing across asset classes and portfolios.

All data runs through automated validation checks and standardization rules to eliminate inconsistencies, errors, and gaps — creating a high-confidence, normalized dataset.

Once validated, the data is loaded into our centralized credit data warehouse. Structured, connected, and compliant, it powers reporting, monitoring, and portfolio insights from a single source of truth.

Data Management

Streamlining Credit Data

We collect and ingest credit data from a wide range of sources — structured or unstructured, internal or third-party — including Excel files, client systems, flat files, and more.

After ingestion, raw data is mapped to our internal credit data model. Field names, structures, and formats are aligned into a unified schema, enabling consistent processing across asset classes and portfolios.

All data runs through automated validation checks and standardization rules to eliminate inconsistencies, errors, and gaps — creating a high-confidence, normalized dataset.

Once validated, the data is loaded into our centralized credit data warehouse. Structured, connected, and compliant, it powers reporting, monitoring, and portfolio insights from a single source of truth.

Our centralized data warehouse powers a complete reporting and analytics ecosystem.

From investor updates and regulatory packages to real-time dashboards and custom exports, every output is driven by validated, structured data — delivered automatically, in the format each stakeholder needs.

Reporting & Analytics

From clean data to clear decisions

Performance Dashboards

Insightful portfolio views for daily monitoring

Regulatory Packages

Audit-ready, standardized, and compliant

Advanced Analytics

Trends, triggers, and strategic insights

Multi-format Delivery

Excel, CSV, API, or platform-based

Investor & Stakeholder Reports

Structured, recurring, fully customizable

Automated Distribution

Right format, right time, right audience

How can we help you?

Over 10 years of success with over EUR 7.5bn of accumulated Assets-under-Management.

Loan servicing

Lorem ipsom about the specific service we offer at Reviva capital

Workout Management

Lorem ipsom about the specific service we offer at Reviva capital

Debt advisory

Lorem ipsom about the specific service we offer at Reviva capital

Capital restructuring

Lorem ipsom about the specific service we offer at Reviva capital